Between increases in living costs and slowing in real wage hikes lurks predatory (and profitable) lending networks.

Between increases in living costs and slowing in real wage hikes lurks predatory (and profitable) lending networks.

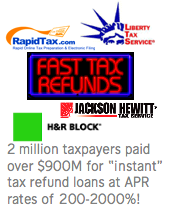

A payday loan is borrowed against a borrower’s future paycheck with fees averaging 390% APR or more (compare to average 18% credit card cash advance).

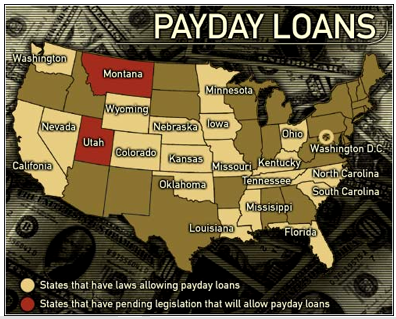

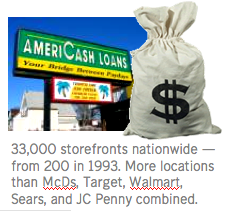

During the past decade payday lending has exploded, generating about $40 billion a year in loans and $6 billion in finance charges while catering to those who live paycheck-to-paycheck or have been shut out of mainstream financial institutions.

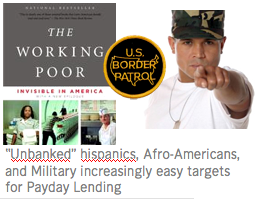

Fueled by banking deregulation, increases in bad/impaired credit, rises in personal debt, and surges in immigrant populations, as many as 14 million of the 105 million U.S. households use payday lenders annually.

Listen to an NPR interview with Howard Kargermore, author of "Shortchanged: Life and Debt in the Fringe Economy" here

Share ideas that inspire. FALLON PLANNERS (and co-conspirators) are freely invited to post trends, commentary, obscure ephemera and insightful rants regarding the experience of branding.

Wednesday, July 12, 2006

Trend: "The Unbanked": Payday Lending

Subscribe to:

Post Comments (Atom)

1 comment:

Payday lending is popular for a reason: it is cheaper than alternatives like NSF charges or late fees. Reputable payday lenders require borrowers to have bank accounts and jobs, so they're not the "unbanked" at all. In fact, 42% own their own homes and the average payday customer earns $25-$50K annually. Let the law of supply and demand work.

Post a Comment